Article In Brief:

Aaron Ross-Connolly, Patersons Securities Limited is a regular commentator on the share market and his industry commentary has been publicised by the ASX. Here, Aaron outlines his summary of how the Australian share market will perform in 2010 and what opportunities will be out there for investors. We don’t want to summarise it as Aaron’s science behind prediction merits that its kept in original form, so we haven’t meddled! Reading Time: 4 minutes

Shares have fallen over the last two weeks on the back of concerns about three primary issues:

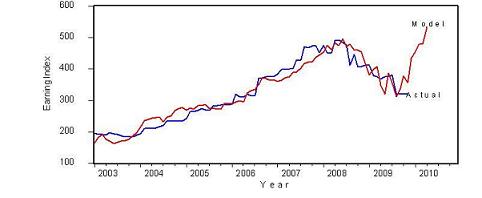

1) China tightening their credit policies (effectively increasing interest rates), 2) the regulation of banks in the US and 3) Sovereign debt risk in the affectionately termed PIGS economies (Portugal, Ireland, Greece and Spain). Despite the significant risks that each of these issues present, we believe that by the end of 2010, after a few inevitable market corrections (as per current circumstances), 2010 will ultimately result in double digit increases in the Australian investment market as our banks, resource and cyclical stocks all benefit from a continued strong recovery in the Australian and broader world economy. Specific Thoughts on Australian Investment Markets When we look at our model of corporate earnings we see strong potential for corporate earnings upgrades through 2010. This is graphically demonstrated in the chart below.

We believe that earnings upgrades will be driven by the fact that company balance sheets are in good condition (low debt), costs have been aggressively taken out of operations (reduced employment) and working capital has been a key focus (as a result of companies focusing on cash).

All of these factors are setting companies up for tremendous operating leverage on relatively modest improvements to sales volumes.

- We expect Australia to have the highest GDP growth in the developed world (our 2010 forecast is +3.7%) and target an All Ordinaries index level of 5,700 points by year end.

US Economic Data The United States remains by far the most important and largest economy in the world. As the GFC showed, the US economy has sufficient influence to create turmoil around the world. As such, like it or not, our investment markets will be linked to US investment market performance and sentiment. We think that there are a number of important factors that investors should be aware of in relation to the US economy for 2010:

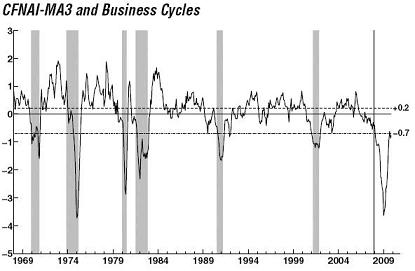

- We believe that the CFNAI (Chicago Fed National Activity Index) provides the best indicator of US economic performance. We would encourage investors to visit the Chicago Fed website ( www.chicagofed.org ) for further explanation of this important index.

- Essentially, the CFNAI is a weighted average of 85 indicators of national US economic activity. A zero value for the index indicates that the US economy is expanding at its historical trend rate of growth. The latest CFNAI reading was -0.61 for December.

- The CFNAI’s current readings and improvement in readings over 2009 confirm our thoughts regarding the US economy returning back to trend growth in 2010 (a zero CFNAI reading). Our current expectation is that US economic growth will be around 2.2% in 2010.

- The shading in the chart below indicates official periods of US recession. The vertical line indicates the most recent business cycle peak. Typically once the index moves through -0.7 the US is out of recession.

- While we have painted a positive picture for the US economy in 2010, we acknowledge that the key threat to the US economy lies not with short term cyclical problems; rather, the net result of current low interest rates and other stimulus policies. That net result will be inflation along with the risk of further financial bubbles.

- We see a potential big inflation problem in 2011/2012 and similarly to the 2003-2007 housing and investment market boom, there will be huge asset appreciation during this period.

- To get a lead on this, we would encourage all investors to watch the interest rate yield on US 10 Year Bonds. As inflation expectations of markets increase, demands for higher compensation (high yields) also increase. One of the best measures of this increase in demand for compensation is bond yields.

- The price chart on the next page shows US 10 Year Bond yields from 1987. There has clearly been a long term down trend in bond yields over the period shown.

- The distinctive characteristic of the ‘2008 Great Recession’ is that it has been a balance sheet crisis embedded in excessive borrowing by individuals.

- Individual debt as a share of disposable income has risen steadily and rapidly over the past three decades and, even after the current financial crisis, the debt ratio remains close to 100%.

- One certain outcome of rising individual debt is that the overall economy’s ability to deal with higher interest rates is greatly reduced.

- Since the 1980’s, not only have interest rates followed a pattern of descending tops and bottoms, but also the ‘choking point’ of rising interest rates for the overall economy has become lower and lower. We have circled in the chart below the major ‘choke’ bond yield events over this time period. We would point out that all of these ‘choke points’ correspond reasonably nicely with some major market peaks including 1987, 1995, 2000 and most recently 2007.

- All of this suggests to us that the next ‘choking point’ for interest rates will be around a bond yield of 4.8% which is significantly lower than the previous interest rate ‘choke points’ and once bond yields return to this level – strong investment caution is warranted.

Recent weakness in shares and other growth assets is likely to be a correction rather than the start of a new bear market. While the correction may have further to go and this year will see more volatility than has been the case since March last year, we remain of the view that profit growth and still low interest rates are likely to underpin further gains in shares this year.

Article submitted by Aaron Ross-Connolly, Patersons Securities Limited – Email: arossconnolly@psl.com.au

Follow Briscoe Search