Pillars of Recovery – 9th July 2009, Aaron Ross-Connolly

Following the largest falls in global share markets since the Great Depression, we identify two indicators as a barometer of global economic health. Importantly for investors, these indicators are suggesting that recent investment market rallies are part of a sustainable improvement.

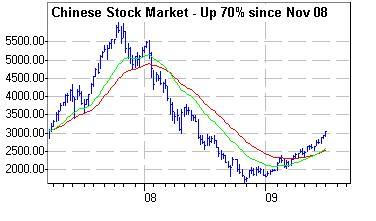

Chinese Economic Recovery : The Chinese Stock Market provides a ready window to view sentiment of this important nation. We expect the Chinese economy to lead global economic growth due to the strength of their national accounts and internal demand. Following falls of over 75% during 2008, the Shanghai Index has rallied over 60% and continues to trend higher.

Chinese Economic Recovery : The Chinese Stock Market provides a ready window to view sentiment of this important nation. We expect the Chinese economy to lead global economic growth due to the strength of their national accounts and internal demand. Following falls of over 75% during 2008, the Shanghai Index has rallied over 60% and continues to trend higher.

CFNAI – Chicago Federal Reserve National Activity Index . This indicator provides a weighted average of 85 indicators of national US economic activity. During 2008, after suffering one of the worst declines since the index began, the CFNAI has had a healthy bounce and continues to improve. We expect the US economy to continue to stabilise before remaining sluggish for some time as the de-leveraging process plays out.

Although economic risks remain high, many economic indicators continue to stabilise and improve. Ongoing recovery in the two major markets of the United States and China remain central to positive investment returns going forward

Aaron Ross-Connolly is an Investment Manager for ABN Amro Morgans, Perth

ABN Amro Logo

Follow Briscoe Search